Asaan Karobar Finance Scheme (آسان کاروبار فنانس سکیم) – 2025

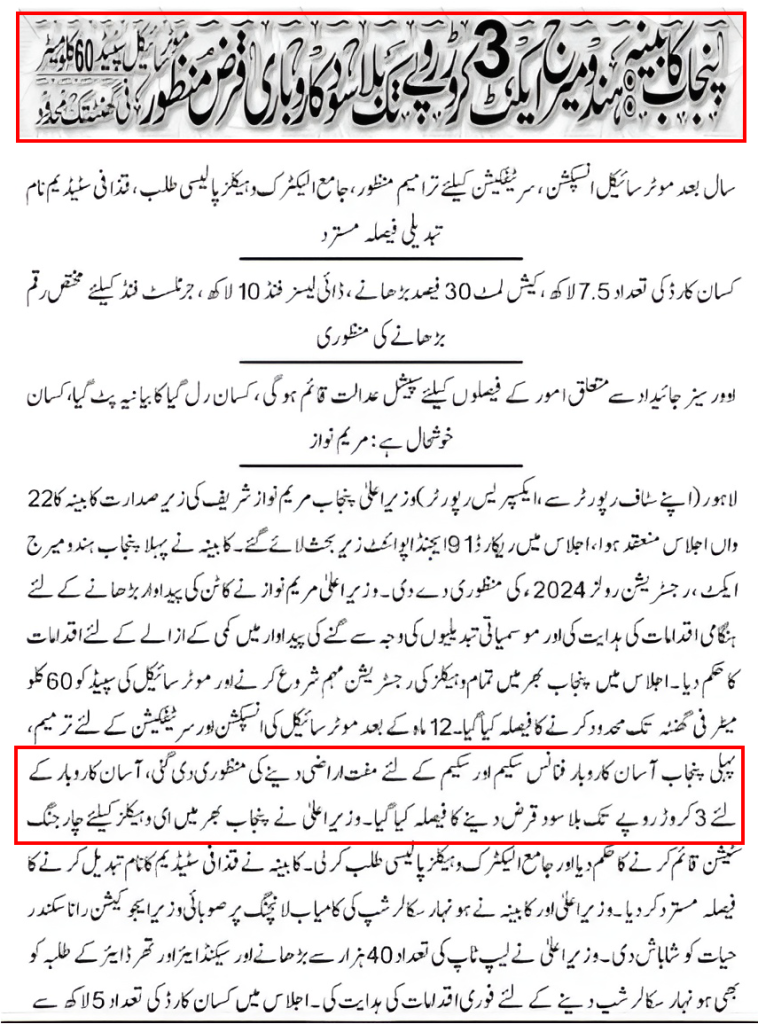

Due to Pakistan’s struggling economy, the Punjab Government has announced a program to boost business and strengthen the economy. The aim is to provide business opportunities for entrepreneurs and set up new start-ups by providing interest-free loans of up to Rs. 30 million. The program is named “Asaan Karobar Finance Scheme” and was recently approved by the Government of Punjab.

Also Check B9 Game

Interest-Free Laon

Laon Amount Up to 30 Million

Up to 5 Years Loan Tenor

Easily Payable Installments

Easy Digitilized Processing

What is Asaan Karobar Finance Scheme?

Asaan Karobar Finance Scheme is the first-of-its-kind multi-million-rupee scheme launched by the Government of Punjab, Pakistan. The aim is to provide interest-free loans of up to Rs. 30 million (Rs. 3 Crore). This financial assistance will be provided to entrepreneurs across various sectors, including agriculture. The main focus is to drive economic development, boost exports, and create jobs.

The Punjab Karobar Finance Scheme was approved in the 22nd Provincial Cabinet Meeting on Tuesday, January 14, 2025. The CM of Punjab, Maryam Nawaz Sharif, also announced the provision of free land for this Asaan Karobar Scheme. Moreover, a target was set to establish 100,000 business start-ups in Punjab. She was also directed to provide business plans for start-ups across the state.

Note: CM Punjab also approved the “Asaan Business Card” or “Asaan Karobar Card” in the Cabinet Meeting.

Objectives of the Asaan Karobar Finance Scheme

Note: This scheme or initiative is open to all sectors, including Agriculture and small and medium enterprises (SMEs).

Benefits of Asaan Karobar Finance Scheme

Additional Incentives

Eligibility Criteria for Asaan Karobar Finance Scheme

The scheme is based and structured into two tiers, which are based on the loan amount. In Tier-1, applicants can get an unsecured loan of up to 5 million, which requires personal guarantees. While in Tier-2, applicants can get a secure loan ranging from Rs. 5 million to Rs. 30 million. However, the applicants must meet the eligibility criteria for the application:

Loan Details

There will be two Tiers whose details are given below:

Tier-1 (T1):

Tier-2 (T2):

Note: The grace period is up to 6 months for start-ups / new businesses and up to 3 months for existing businesses.

Equity Contribution

Additional Costs

Repayment Terms

Asaan Karobar Finance Scheme Apply Online

Step 01: Click Apply Button

Step 02: Profile Information

Note: Please double-check your personal information as it will not be changed after registration.

Step 03: Loan Details

Step 04: Business Details

Step 05: Financial Details

Step 06: References

Step 07: Documentation

More About Asaan Karobar Finance Scheme

The Government of Punjab is also planning to launch Phase II of the Asaan Karobar Finance Scheme in the fiscal year 2025-26 with an extended scope of Rs100 billion. This phase is aimed at accommodating 24,000 small and medium enterprises (SMEs). The total loan disbursement is set up to Rs. 379 billion.

Helpline Number

Also Check: How to “Submit a Complaint for Asaan Karobar Finance Scheme.”

Asaan Karobar Card (Asaan Business Card)

Additionally, the Government of Punjab approved the launch of the Asaan Business Card or Asaan Karobar Card. The aim is to facilitate small entrepreneurs across the state by providing interest-free loans of up to Rs.1 million for three years. Moreover, to ensure effective use, the funds will be allocated for business-related activities through digital platforms. The target is set up to benefit over 100,000 small businesses across the province.

CM Punjab Maryam Nawaz

This initiative is taken by the CM of Punjab, Maryam Nawaz Sharif. It is part of her reform package, whose aim is to strengthen the economic condition and financial well-being across Punjab. Moreover, it’s a step towards enhancing housing and agriculture standards as well as promoting renewable energy sectors.

Frequently Asked Questions

Conclusion

Asaan Karobar Finance Scheme is an interest-free loan scheme announced by the Government of Punjab, Pakistan. Its objective is to provide opportunities for entrepreneurs to set up and strengthen businesses across the province. Moreover, empowering and modernizing the existing business is also included in the preferences.

The Government will provide up to 30 million Pakistani Rupees to boost economic growth and establish businesses across the state. Moreover, the eligibility criteria are simple, and the requirements are easy to fulfill. However, the official announcement of the application will be made soon. Please stay updated to get benefits from the scheme and contact us in case of any queries.