CM Punjab Asaan Karobar Exports/SME | Eligibility Criteria | Application Process

The Government of Punjab has launched Phase 2 of the Asaan Karobar Finance Scheme. In this phase, the Punjab residents can apply for loans for Finance and Exports/SME separately, depending upon the nature of their businesses. In Export/SME, applicants/exporting business owners can apply for a loan amount of up to 50 million PKR. Below is the complete step-by-step application process with eligibility criteria and other information.

Markup Rate

Loan Tenure

Loan Amount

Instructions to Apply for Asaan Karobar Finance Exports/SME

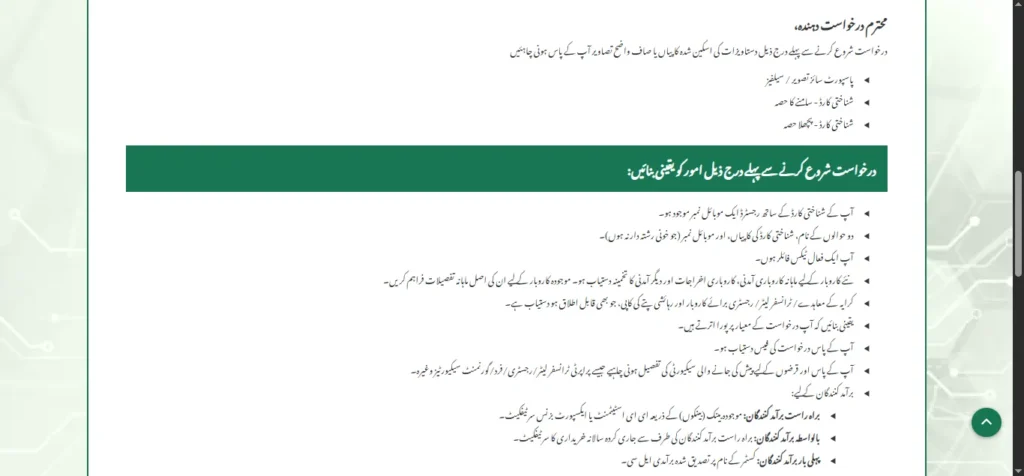

Please ensure to have scanned copies or clear, visible pictures of the following documents ready before starting your application:

Please ensure the following before applying to Asaan Karobar Finance Exports/SME

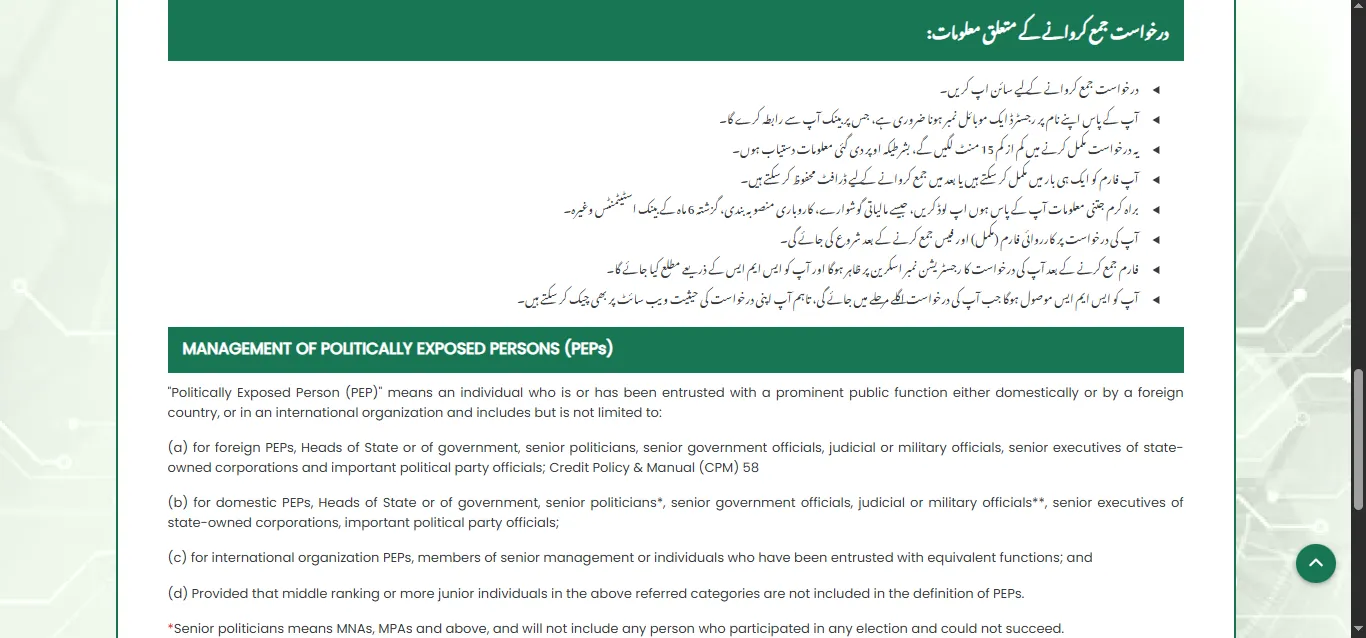

Guidelines for Application Submission

Note: You can also read more about the Management of Politically Exposed Persons (PEPs) before starting the application process.

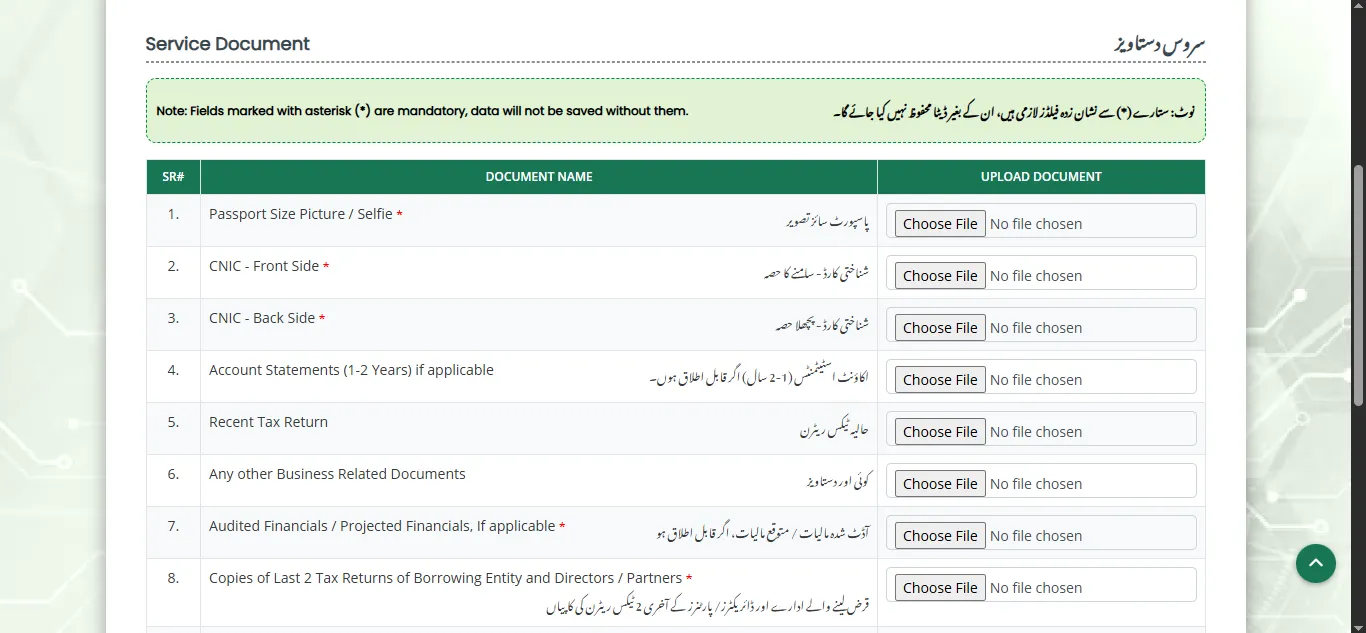

Required Documents to Apply for Asaan Karobar Finance Exports/SME

Note: The documents with an asterisk (*) sign are mandatory to upload; otherwise, your application will not be submitted. Please upload as much information as possible, other than what is required.

Eligibility Criteria for Asaan Karobar Finance Export/SME

Apply for Asaan Karobar Finance Exports/SME Online

Below is the complete step-by-step process to apply for the Asaan Karobar Exports/SME Finance Scheme:

Step 01: Click the “Apply” Button

Step 02: Provide Applicant’s Details

Note: Please skip this step if you have applied in the previous phase and have an account.

Step 03: Login

- After clicking the “Register” button, you will be navigated to the “Login” page.

- Here, you will enter your CNIC number along with the password you have entered.

- Enter the captcha and click on the “Login” button.

- After logging in, you will navigate to the

Step 04: Profile Information

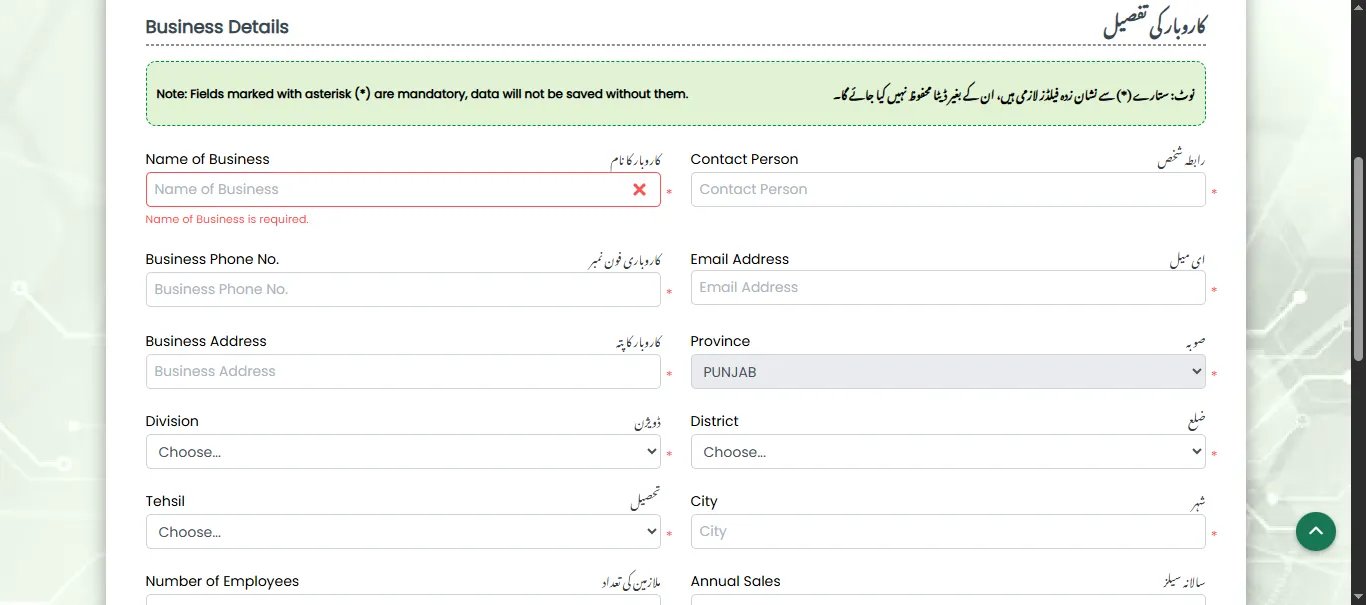

Step 05: Business Details

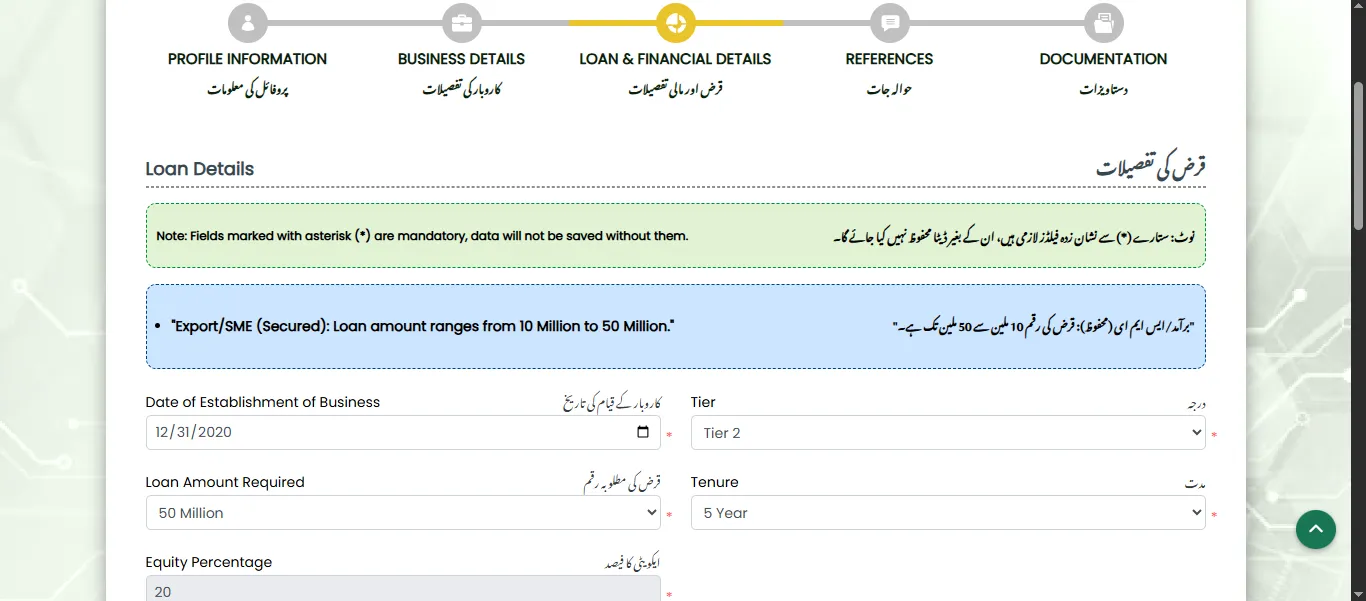

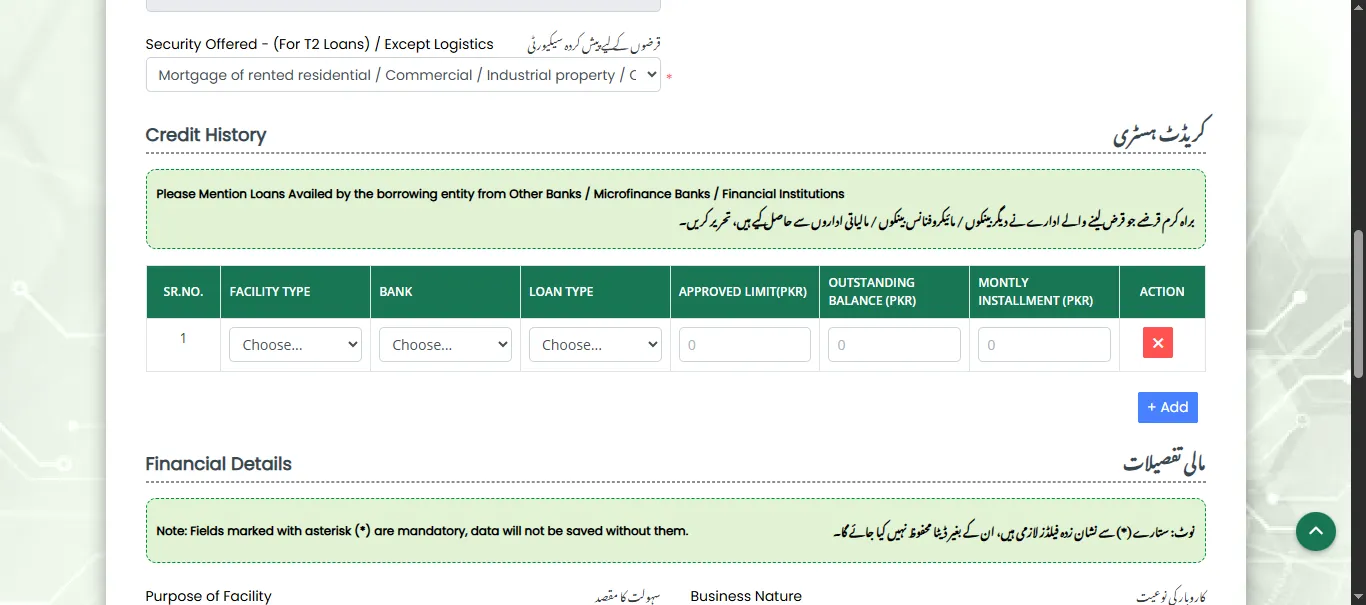

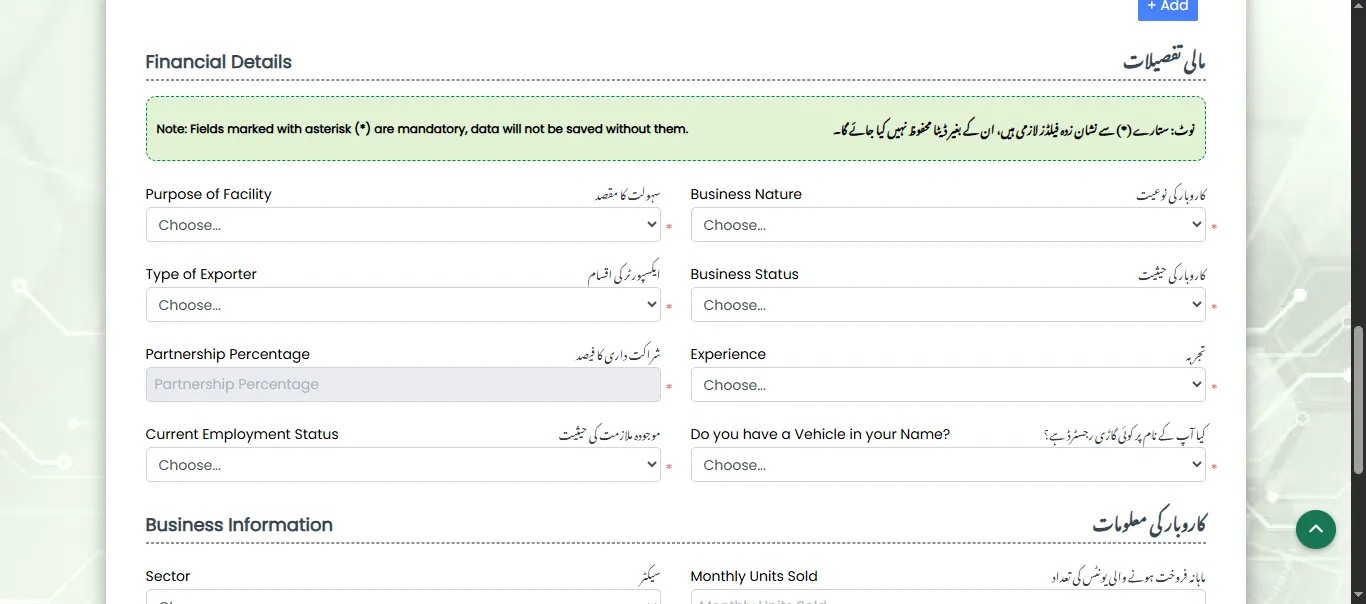

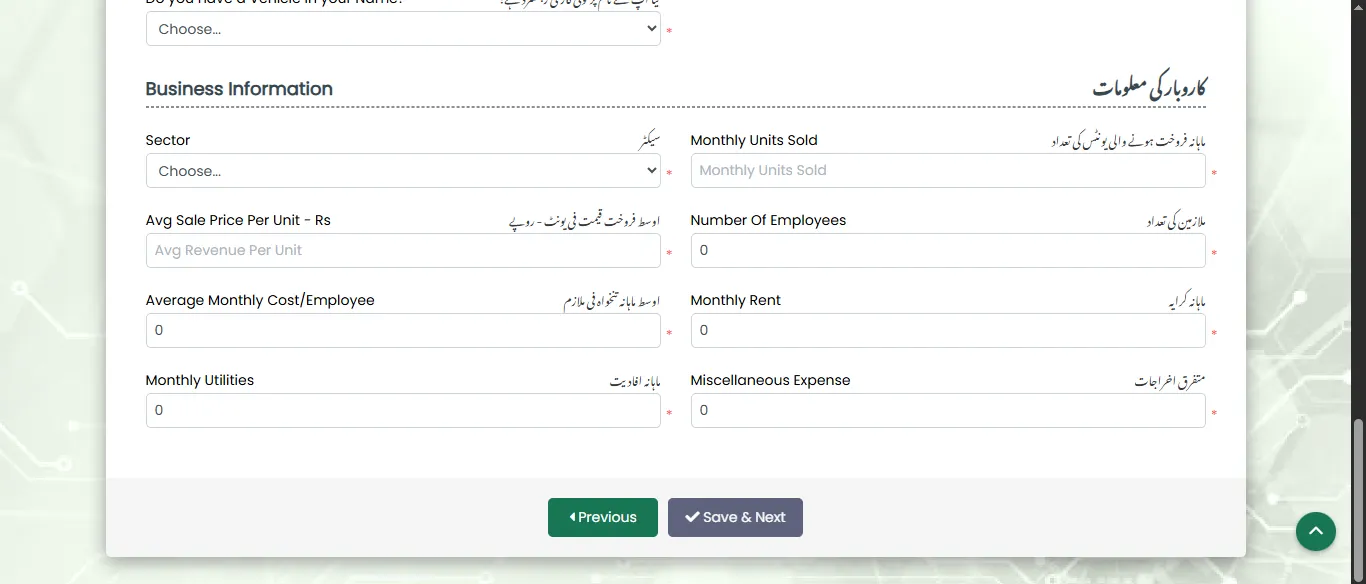

Step 06: Loan & Financial Details

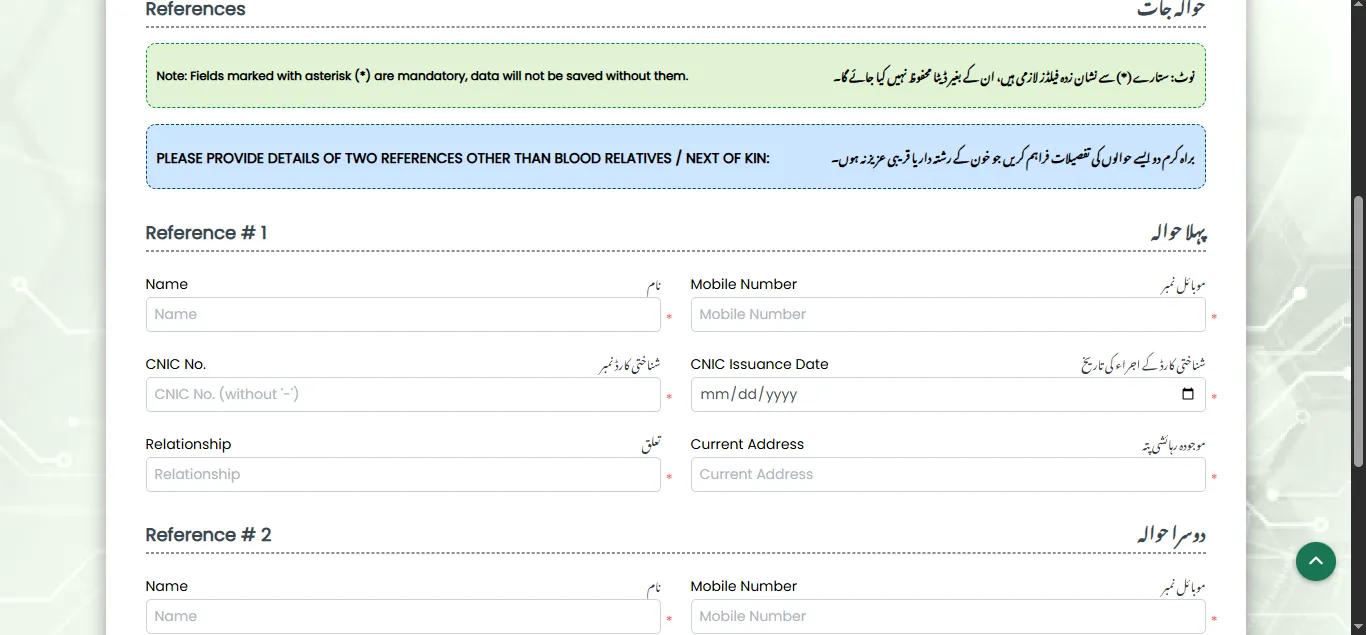

Step 07: References

Step 08: Documentation

Note: Application processing will begin after submitting the application fee.

Helpline Number

Also Check: How to “Submit a Complaint for Asaan Karobar Finance Scheme.”