Prime Minister/PM Youth Business & Agriculture Loan Scheme (PMYB&ALS) – 2025

The Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYB&ALS) was launched by the Prime Minister of Pakistan. It aims to help the youth of Pakistan. In this plan, the loan will be given on easy terms and conditions. This will help young entrepreneurs start new businesses and update their current/existing businesses.

What is the PM Youth Business and Agriculture Loan Scheme (PMYB&ALS)?

The Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYB&ALS) is a program offered by the Government of Pakistan. It aims to support young people in starting their own businesses and exploring new opportunities. The aim is to explore entrepreneurial opportunities and uplift the SME & Agriculture sector by providing affordable business loans on simple terms. Moreover, the loan will be provided with no or less markup through multiple Islamic, Commercial, and SME banks.

Objectives of the PM Youth Business and Agriculture Loan Scheme

Benefits of the PMYB&ALS

Eligibility Criteria PM Youth Business and Agriculture Loan Scheme (PMYB&ALS)

Loan Details

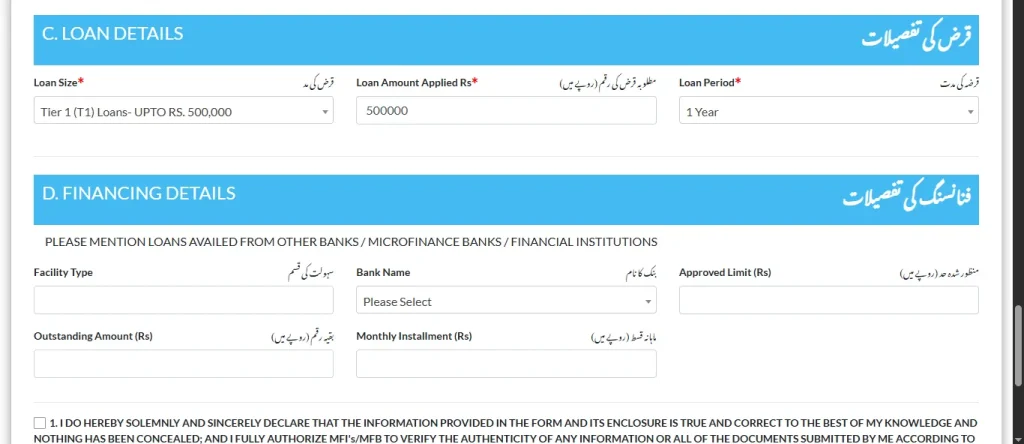

The loans from the Prime Minister’s Youth Business & Agriculture Loan Scheme are in three tiers. Here they are:

Tier 1

Tier 2

Tier 3

How to Apply PM Youth Business and Agriculture Loan Scheme (PMYB&ALS)

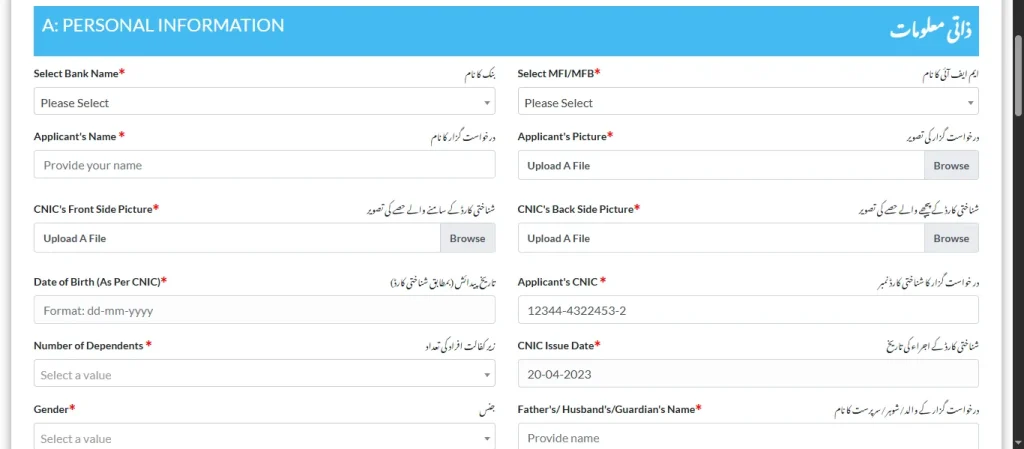

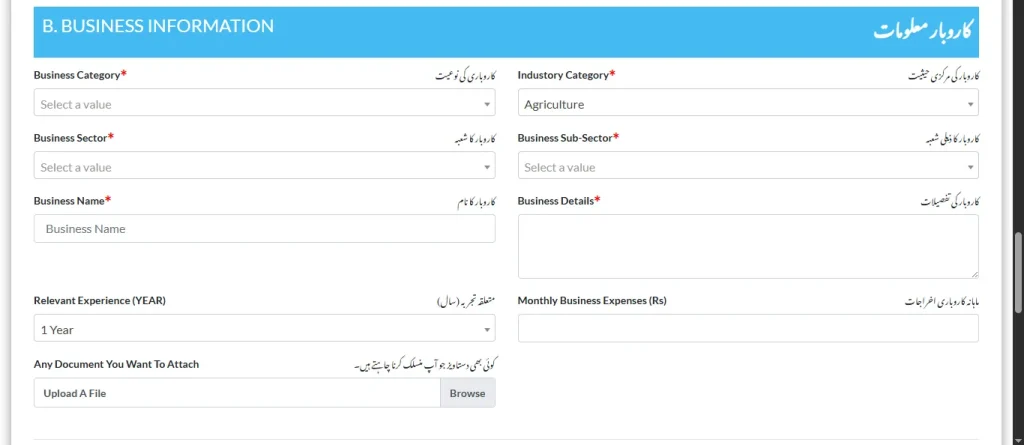

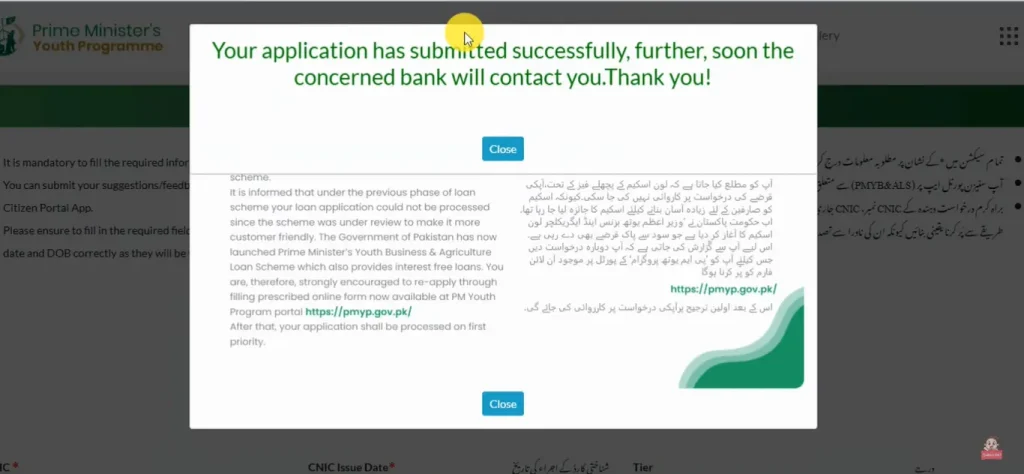

Please note that the application will be submitted online only. Here is the step-by-step process to apply for the Prime Minister’s Loan Scheme (Tier 1):

Important Instructions Regarding the Application for the PM Youth Business and Agriculture Loan Scheme

Check Your Application Status for PM Youth Business & Agriculture Loan Scheme (PMYB&ALS)

After the successful submission of the application, you can check your application status later on. Here’s how you can check it:

Loan Repayment Calculator

The Loan Repayment calculator helps in calculating the loan repayment schedule for the Prime Minister’s Youth Business & Agriculture Loan Scheme. Please click on the button below to access it.

Frequently Asked Questions

Conclusion

The PM Youth Business and Agriculture Loan Scheme is an initiative by the Prime Minister of Pakistan to provide easy loans to youth. The objective of this loan scheme is to help you, entrepreneurs, to establish new businesses, and modernize and expand existing businesses. This initiative will help boost the economy of Pakistan.

In this scheme, the young entrepreneurs could get a loan of up to 7.5 million PKR. The loan scheme is segmented into three tiers (Tier 1, Tier 2, Tier 3). Please read the instructions carefully before applying for any tier. A complete step-by-step process is provided above to apply for the Prime Minister’s loan scheme.